Are your risks under control?

Beginning with bushfires ravaging New South Wales (and across the country) then followed swiftly by covid-19, 2020 was undoubtedly a challenging year for Australians. In fact, it would be almost impossible to have predicted the scale of global disruption 2020 brought forth. As countries across the globe grapple with keeping the covid-19 virus under control and others (like Australia) begin to slowly return to some semblance of normal, we can only hope such an event will not occur again for a long time.

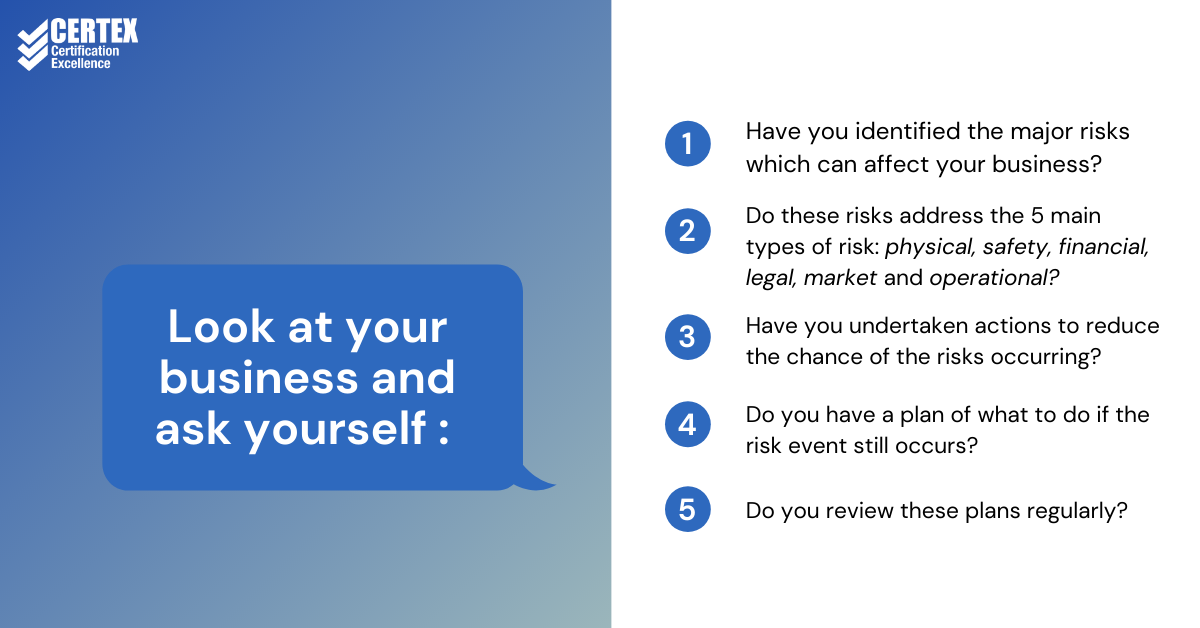

Our lives are full of risks. Risk exists in everything we do – from crossing the road, to battling high winds and searing temperatures. Similarly, risks exist in our businesses too. It may be a good time to ask how well you understand the risks facing your business?

What is a risk?

A risk is the possibility of an adverse event occurring and the likely consequences of this event. A risk is generally out of your control, although you can take steps to minimise it.

Risk management?

Risk management is a systematic approach to identifying, evaluating, planning and monitoring risks so that the risk is reduced to an acceptable level.

Good risk management is generally recognized as simply a part of good management and planning. After all, the consequences of mismanaging an adverse risk event can come in the form of financial loss, loss of customers, or even put you out of business. What were they thinking (or why were they not thinking) when the relevant systems and protocols were being put in place?

Closer to home there is the ever-present risk of losing data as a result of an IT crash and all well run companies should have a reliable backup system in place to mitigate this risk.

But there are other risks which face your business.

Identifying Risks

As an owner/operator of a business without formal governance structures in place, it can be difficult to take yourself out of the operations of the business to consider the broader landscape of risk.

In identifying these risks, think about how your customers will react if an adverse event results in an inability to service your customers. If your customers can’t contact you, or you can’t access your database, what will your customers do – call someone else perhaps?

Also, think about the fact that in a disaster, a major adverse event, it is often our candidates and workers that are needed to help manage the event and repair the damage. Your tradies and blue-collar workers are the ones needed to clear the streets and remove the rubbish; your doctors and nurses are front-line workers during a pandemic. How can you manage risks so that your workers are protected?

Viewing risk management as both a separate activity (e.g., annual risk reviews) and as a part of daily operations will help keep you observe the changing risk landscape. Clearly, not all risks can be predicted or minimised, but it is far better to be prepared.

Certex's Risk Assessments in safety, privacy, employment practices, and right to work can provide you with an understanding of the risks you face in key compliance areas. Can you be sure that you're complying with all the complicated legislation? Why not have a professional check your business and help you ensure that you're managing your business risks.

Find out more below